Today, 20% of Americans over 50 have no retirement savings, and more than half are not sure if they will have enough. Finding ways to put money aside for retirement and maximize your savings can be challenging when you don’t have a map.

Find Out: Can You Really Follow Dave Ramsey’s 8% Retirement Rule?

Learn more: 7 Common Debt Scenarios That Could Impact Your Retirement—and How to Deal With Them

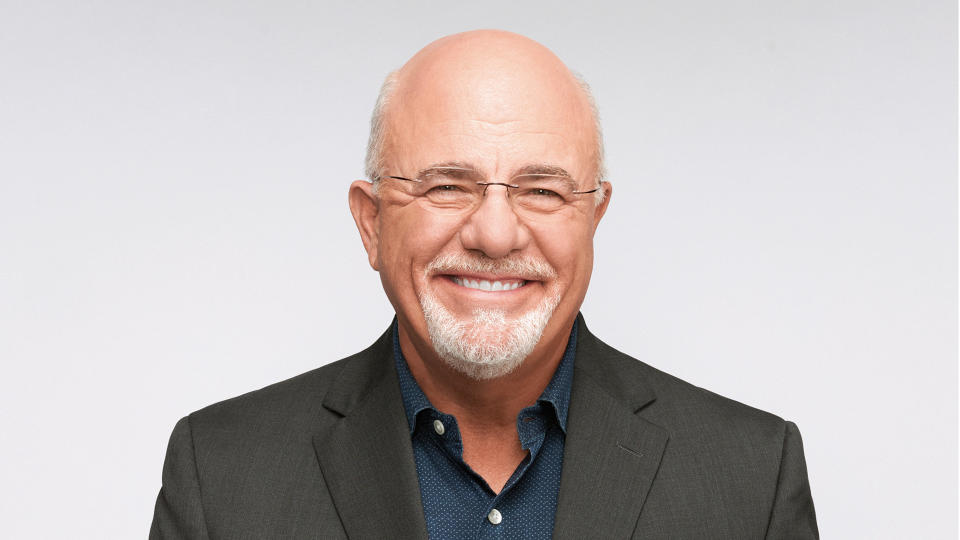

Dave Ramsey, personal finance expert and host of the investing podcast “The Ramsey Show,” has plenty of advice about retirement planning. His team has broken down nine steps anyone can use to secure their finances when it comes time to retire.

Rich people know the best money secrets. Learn how to copy them.

Make retirement goals

Having a plan and saving with purpose is essential to living financially free in retirement. This requires you to make a retirement goal. To do this, you need to determine what you want to do in retirement. Don’t start with a savings goal that you just think will be enough.

Ramsey’s team suggested asking yourself what your dream would be. It could be relaxing and spending time with grandchildren or traveling around the Mediterranean. Having a very clear idea of what you want will allow you to calculate how much you will need to make it a reality.

With your retirement goal in mind, you can create a precise strategy to achieve it. Each plan will vary depending on how much you already have saved, your debts and your financial obligations.

Be Aware: 9 Retirement Planning Moves You Should Make Now If You’re Worried About the Economy

Withdraw 15% of your income

It’s impossible to save for retirement without making a sacrifice and setting aside a percentage of your income each month. Your savings will depend on your financial situation, but the Ramsey team recommends saving and investing at least 15% of your gross income.

Saving 15% of your income and investing it in an individual retirement fund or a 401(k) will add up over years of contributions. Leaving 85% of your salary for the rest of your financial needs allows you some flexibility. If you can save more than 15%, you’ll have more money generating income in retirement. However, those who live paycheck to paycheck may find it difficult to put away 15% of their income and could benefit from any amount of savings.

Invest in your 401(k).

Many employers offer 401(k) plans, which are great ways to build up retirement savings. A 401(k) is a tax-advantaged retirement plan. Employees receive a portion of their pre-tax paychecks deducted from their monthly paychecks and deposited directly into their 401(k) accounts. The plan invests their monthly contributions in predetermined assets, which can grow without capital gains tax. When the employee retires, the IRS taxes distributions withdrawn from their 401(k).

Contributing to your 401(k) has a big advantage besides the tax benefit. Ramsey noted that many companies offer an employee match based on your contributions. If you put $100 into your 401(k) each month, a participating employer can add another $100. Your $200 will grow over time through investments, adding even more to your retirement savings. The employee match alone is a great reason to sign up for a 401(k). How much the employee matches will vary by company, but is often a percentage of the employee’s salary.

Open a Roth IRA

Regardless of whether you have a 401(k), there is another retirement investment option. A Roth IRA is a retirement account in which you can put a limited amount of after-tax dollars each year to invest. Because the money deposited is after-tax dollars, the IRS does not tax your earnings or withdrawals in retirement.

Ramsey noted that there is another big advantage to investing in a Roth IRA besides the tax benefits. Unlike a 401(k), you have complete control of your investments. You can invest your money in stocks, mutual funds, commodities or other assets.

Get out of debt – including your mortgage

Maxing out your retirement accounts and saving for retirement can only get you so far if you haven’t paid off your debts. One of the most common and longest debts is a mortgage. The Ramsey team explained that debt is a risk and that falling behind on your mortgage payments in retirement can have devastating consequences. He suggested paying off your mortgage quickly by paying more than the minimum each month, especially as your income increases over the course of your career.

Remember that you don’t want to wind up with any more debt. Personal loans and credit card debt can quickly cut into your savings. Planning to take on these smaller debts can ensure you start accumulating some savings sooner. Two effective plans are the snow and avalanche methods.

When you have a lot of debt, the snowballing method helps you gain momentum to pay it off. Start with the smallest debt and pay it off in full. Then, move on to the second smallest debt and continue in that order until you have paid off all of your debts. Paying off one debt after another in full will lead to a sense of accomplishment instead of paying off randomly and feeling like you’re not making progress.

The avalanche method is similar, but it prioritizes debts based on their interest rates. Debt with high interest rates, such as credit cards, costs you more over time. Putting extra money toward paying off the highest interest debts first will help you pay off faster and save money. Once you’ve paid off your small debts and mortgage, you can divert all of those monthly payments toward your retirement savings.

Know your Social Security choices

The future of Social Security is unknown. The Social Security Administration recently reported that the program will continue to exist until at least 2035, but retirees should plan to receive only 83% of their benefits. This means you don’t have to depend entirely on Social Security, but you still need to understand your options.

The Ramsey team broke down the options you have for Social Security. You can apply for benefits at any age between 62 and 70. If you file for Social Security benefits at age 62, you’ll be eligible for up to $2,710 each month. If you wait until age 66, you’ll get up to $3,652 a month. Waiting to file until you turn 70 gives you the highest monthly value of up to $4,873.

Determining which route is best for you depends on your personal preferences.

Prepare for health care expenses

One area that many overlook when planning for retirement is their health care expenses. As you age, your health will deteriorate. Retirement without an adequate strategy can mean you’ll have to make large withdrawals from your savings earlier than you expected, which can mess up your finances for years.

Ramsey’s team gave two suggestions on how to plan ahead. The first is to open a health savings account. In an HSA, you set aside pre-tax money to use later to pay for qualified medical expenses. An HSA allows you to use tax-free money to cover deductibles, copayments, coinsurance and other expenses. It is also possible to grow your HSA by investing.

The second suggestion is to sign up for Medicare when you are 65. Medicare is federal health insurance that can help take the stress out of covering your health care expenses during retirement. Ramsey’s team noted that you can still sign up for benefits while working.

Think Big Picture

With all the stresses life throws at you, it’s easy to lose track of the big picture. When unexpected car trouble or a family emergency occurs, there’s a risk that your retirement plan will be put on the back burner and forgotten about entirely.

Ramsey’s team said feelings like fear, anxiety and impulsivity can creep in to wreak havoc on your retirement savings goals. A bad situation can cause you to withdraw your money from your retirement funds early, racking up stiff penalties. Or, a sudden drop in the stock market may tempt you to give up investing altogether.

Making a plan and sticking to it is hard. It requires a lot of patience and persistence to work. Keeping a long-term perspective and letting go of the temptations and challenges of the present is a vital step in securing your retirement finances.

Use a financial advisor

Coming up with and executing the best retirement strategy can put a lot of pressure on you. When your future is at stake, sometimes it’s better to spend a little more to make sure you’re on the right track. Talking to a financial advisor can help ensure you’re on the path to a happy retirement.

Ramsey’s financial consultancy, Ramsey Solutions, conducted a survey and found that 68% of millionaires it spoke to used a financial advisor to achieve financial success. Consulting with a person can help you form and achieve your financial goal. It doesn’t hurt to get some guidance if you’re not sure how effective your retirement plan is.

More from GOBankingRates

This article originally appeared on GOBankingRates.com: How to Plan for Retirement in 9 Steps, According to Dave Ramsey

#plan #retirement #steps #Dave #Ramsey

Image Source : finance.yahoo.com